Disclaimer:

The information contained in this document should not be considered as investment advice, its only describes the characteristics of theoretical products for your better understanding.

Disclaimer:

The information contained in this document should not be considered as investment advice, its only describes the characteristics of theoretical products for your better understanding.

RWA Concept

A Ready, Willing and Able Letter (RWA) is a document issued by a bank or financial institution for their clients. It demonstrates the intent and capability of the clients to enter into a financial business transaction both legally and financially.

After being issued, the Ready, Willing and Able Letter (RWA) is sent to the beneficiary via MT799 SWIFT message.

Legally, Ready willing and able refers to fully prepared to act, as in prepared to perform the services required under a contract.

A RWA letter is a document issued by a bank on behalf of a client to prove his readiness and his intent to participate in a financial transaction. The letter is issued by one bank to another, usually with Swift MT799.

A Ready Willing and Able Letter (RWA Letter) is a bank instrument that verifiy’s a bank or financial institution is Ready Willing and Able (RWA) to proceed on behalf of a client in any number of various financial transactions. An RWA Letter is usually sent from a buyer’s bank to the seller’s bank and is commonly sent together with a SWIFT MT-799. While an RWA Letter is sometimes issued without a SWIFT message bank to bank, it carries more weight for buyers and investors if it is sent in conjunction with a SWIFT MT-799. If an RWA Letter is required by itself, and a SWIFT transaction is not required by the seller, a bank or trust can send a Ready willing and Able Letter (RWA) by other less common means as requested by the seller or the sellers bank.

With this document, the bank confirms:

In particular, ‘willing’ means that the purchaser should be prepared to put his signature to a binding contract on the terms offered and be bound thereby; “for the words ‘ready and willing’ imply not only the disposition, but the capacity to do the act”,

‘Ability’ to purchase depends primarily on financial ability. This does not necessarily mean that the funds must be immediately to hand in the bank. If the purchaser has sufficient and demonstrable financial means, or if the required funds can be realised from the sale of another property in time to consummate the proposed transaction, the purchaser may be considered ‘able to purchase’.

In summary, in English law, it has been said that for a person to be ‘ready, able and willing’ to buy a property on terms deemed acceptable to the seller, the purchaser “must be a person who is ‘able’ at the proper time to complete; that is, he must have the necessary financial resources. He must also be ‘ready’; that is, he must have made all necessary preparations by having the cash or a banker’s draft ready to hand over. He must also be ‘willing’; that is, he must be willing to hand over the money in return for the conveyance

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is an organization that is responsible for an international network of financial communications between banks and other financial entities. In December 2018, it had more than 11,000 financial entities linked in 204 countries and it operates 24 hours a day, seven days a week. It is estimated that in 2001 it transmitted payment order messages with an average value of more than six billion US dollars (6,000,000,000 USD) per day in 2001, and that in 2005 it transmitted close to 2.3 billion messages.

SWIFT is a cooperative society under Belgian law, owned by its own members as partners, with offices around the world. The head office is in La Hulpe, near Brussels.

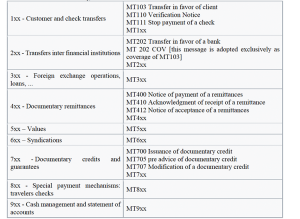

The “MT” in the beginning of the code means “Message Type”, and the number indicates one of the standard message formats that make up the SWIFT messaging system. These are grouped into categories according to their first digit. Each message category is made up of different subcategories, as can be seen in the following table:

SWIFT MT-103 are the most common forms of SWIFT communication, and many people have unknowingly used it. For most people they are known as bank transfers. A SWIFT MT-103 is used by the bank when customers want payment to customers of another bank in another country. They are also called Bank Drafts.

Message fields:

Other Fields that would appear if the Payment Order were indirect. It will be indirect, when there is no direct relationship between the issuing bank and the paying bank, and the intervention of one or two additional banks will be necessary.

In the case of the Indirect Payment Order, the financial institution will send a 2nd SWIFT MT 202 COV message. This message is adopted as exclusive for MT103 coverage. The MT 202 COV includes data on the payer, and beneficiary of the linked MT 103, so that the bank that receives the MT 202 COV, knows data from the parties involved.

How can you send an MT-103? The MT-103 is the most widely used SWIFT message. To send one, contact your bank and let them know that you want to send a bank transfer. The bank details of the beneficiary are required, as well as the SWIFT code of the beneficiary’s bank.

How long does an MT-103 take?

It is sent almost immediately, and if you are the sender, the money is debited from your account directly. It generally takes between three to five business days for the beneficiary to have the funds in their account, depending on the processing times of their bank, and the origin and destination of the message.

Are MT-103 messages reversible? No. Once the MT-103 has been made, it is not reversible. Sending an MT-103 is the equivalent of sending money, cash, to someone.

It is a free SWIFT format in which a banking institution confirms that the funds are in place to cover a commercial potential. This may, at times, be used as an irrevocable commitment, according to the language used in the MT-799, but it is not a promise of remuneration, or any other form of bank guarantee, in its standard format. The function of the MT-799 is simply to guarantee the seller, that the buyer, has the necessary funds to complete the operation.

The MT-799 is generally issued before a signed contract, and before a letter of credit or bank guarantee.

What is done with an MT-799?

The MT-799 is an automated message, sent electronically, from one bank to another, so you can’t really “see” a MT-799 at all. The procedures related to an MT-799 correspond from bank to bank, although most banks follow a similar format.

It is a type of SWIFT message known as “Guarantee”, as its name indicates, it works as a Bank Guarantee, and is therefore important publicity of its scope.

The Investor’s Bank issues a SWIFT MT-760, using an Asset (CASH, BG, CD, MTN, etc.) as a basis. Said asset is issued in favor of the Beneficiary (The recipient of that MT-760). This type of message is used in import or export businesses of any product. The issuing bank uses this asset as collateral, in favor of the receiving customer of the MT-760. It is also important to emphasize that this is the classic blocking option for participation in a Private Placement Program (PPP).

SWIFT MT-760 issuance operation. Before proceeding to issue a SWIFT MT-760, the Issuing Bank will issue a SWIFT MT-799 (Free message). This MT-799 verifies the concept of pre-advice (Notifying the Receiving Bank that a guarantee in the form of MT-760 will be issued). Then, in the following 24 / 48h, the receiving bank issues a SWIFT MT-799 to the Issuing Bank confirming that they are ready to receive said MT-760. In the next 24 / 48h, the client’s bank issues the SWIFT MT-760, accepting it from the bank’s receiver. In this way, the asset is LOCKED, a favor of the beneficiary, during the time stipulated in the text of the SWIFT message.

When you issue an MT-760, can I revoke it? Absolutely NOT. Many intermediaries affirm to the Investor that the MT-760 can be revoked without problems, when the investor wishes, when the reality is quite different. When a SWIFT MT-760 is issued, and accepted, by the receiving bank, it is totally IRREVOCABLE. And it can only be revoked, if the beneficiary of the MT-760 gives his consent to his bank, to proceed with its revocation.

The documentary credit / Letter of credit is an agreement by virtue of which, the bank of the importer, called Issuing Bank, on request of his client, and under his instructions, is obligated to pay, to a third party, or to authorize another bank, to make a payment, upon presentation of the required documents, within the agreed period, provided that the terms and conditions of the credit have been met. Thus, the seller has the guarantee that he will collect his order, as long as he complies with the provisions of the credit. This allows them to start manufacturing and speed up the transformation with ease. Also, the seller is shipped more securely, if the Issuing Bank has an international reputation.

The exporter can add an additional guarantee to the operation, using a Confirming Bank. This is highly recommended, in case the Issuing Bank has a low credit rating, or if the buyer is in a country with a medium high political risk. Confirmation is a guarantee provided by the exporter’s bank, in the same terms that the import bank has issued, a guarantee conditional on the conditional good compliance of the documentary credit. Thus, the exporter ensures that his bank assumes all the insolvency risk, and political risk, of the issuing bank.

Parties involved:

Documentary Credit Modalities: Basically there are two modalities of Documentary Credits.

The standby letter of credit, also called SBLC by its initials in English, is a form of atypical guarantee, of abstract calls, which is, in its form and function, located among the independent guarantees (guarantee on first request or guarantee to first demand or similar) and the guaranteed means of payment of international trade (documentary credit), and are conceived as something very similar to the guarantee on first demand.

Despite being able to be modified as a documentary credit option, the SBLC’s main function is to serve as an international guarantee. Being its scope greater than that of a local guarantee, such as the letter of guarantee.

Among the main advantages are uniformity in application and execution at the international level (supported by the UCP 600 and ISP98 rules of the International Chamber of Commerce), as well as the support of the financial institutions that issue or confirm.

In the case of the standby letter of credit, the financial institution commits itself to a beneficiary, eg a supplier, an exporter or a merchant, makes a payment instead of the client in case the client is not in a position to fulfill their contractual obligations and in case the beneficiary presents a demand for payment in writing.

Through the LCSB, the financial institution guarantees that, even in the event that the company ceases to operate, becomes insolvent or cannot pay for any reason, the commercial obligations and conditions of the agreement do not cease to be fulfilled.

The commitments and obligations that can be backed by an SBLC can be of various kinds; however, we can group them as follows:

Non-Disclosure Agreement (NDA), also referred to as confidentiality contracts or agreements, is a legal contract between at least two entities to share confidential material or knowledge for certain risks, but restricting its public use. More formally, these texts can also be titled as a Confidentiality and Non-Disclosure Agreement. NDA creates a confidential relationship between the participants to protect any trade secret. Therefore, an NDA can protect the information of a private company.

NDAs are typically signed when two companies or individuals agree to a business relationship and need to understand the processes used in the other company for the purpose of evaluating the interest of that relationship. Confidentiality agreements can be mutual, so that the two parties have restrictions on the use of the affected information, or they can only affect one of the parties.

It is also common for an employee to sign a confidentiality agreement or similar agreement at the time of hiring. They are very common in the field of information technology.

These can be unilateral, bilateral or multilateral.

An Irrevocable Commission Protection Agreement, known in English as the Irrevocable Master Fee Protection Agreement (IMFPA), generally applies to one of the Over-the-counter (OTC) products. It is an irrevocable and binding legal agreement between a buyer, a seller and a business intermediary.

In an IMFPA, the objective is to reach a private agreement for the placement or purchase of a product, or service, which has been identified and negotiated in bulk. The buyer or seller offers to a private business intermediary, a fee or commission (either a fixed sum or a percentage), to organize the amount. The fee is only paid, if, and when the transaction is completed. The amount of the commission, and when it will be paid, is determined by the aforementioned rate agreement. In general, fees are automatically transferred from the buyer’s bank account to the business intermediary when the buyer pays for the product.

In general terms, is the process of converting something into money. The term has a wide range of uses. In banking, the term refers to the process of converting or establishing something in legal tender.

IN FINANCE

Many people (natural or legal), possess, bank instruments, or financial instruments. If they need cash, immediately, there are investors, or companies, that are in the business of monetizing instruments, issued by banks. Basically, this means that they will provide liquid assets for the person (or company), and will take possession of certain types of instruments. This may mean that investors, who monetize, hold the bank instrument, as collateral, against a loan to the company, for a specific project, in the short term, in exchange for a cut in profits, at the end of the project (discount). These types of financial instruments may include:

Investors looking to get involved in this business have a few options. First of all, they need some capital. The very nature of business, of monetization instruments, requires money. Most of those looking for this service are looking for cash, ready to finance a particular business venture. However, some monetization companies change bank instruments, for the entry of the trading platform, or a combination of cash, and the entry of the trading platform. The process generally takes three to ten days. This is normally done to finance a project that will produce returns in the future, but which must have short-term cash from investors. Companies offering this service often have several stipulations that must be met before establishing a binding contract.

Some companies that offer monetization instrument services will only accept instruments from certain banks. Because they want to guarantee the reliability of the instrument, they only work with instruments from those banks they trust.